1099 Report

If you paid subcontractors during the year, the IRS requires you to submit 1099 Forms. This option prints the form information on preprinted 1099 forms or plain paper (if you use preprinted forms, you must use a laser printer). If you are sending a printed version of Copy A to the IRS, you must use the red preprinted form so it can be scanned.

To reconcile your vendor payments before you print the report, select the 1099 Summary option from the Report Type drop-down list.

If you reset vendor totals before you generated 1099s for the year, you can select the Use Last Year 1099 Amount check box to use the information from the previous year stored in the Master Vendor file. You can see which year is the current year by selecting Options > Set Up the Module Preferences. The year in the Current Year End box is the current year.

The 1099 Report lets you print test copies to ensure the information is placed correctly on the form before you start to print the forms. It also lets you print more than one copy.

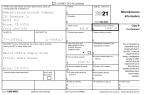

To print this report, select Reporting > 1099-MISC Report or Reporting > 1099-NEC Report from the left navigation pane. Choose the NEC option only if you are printing Non-Employee Compensation. In the AP 1099 window, enter the criteria you want to appear on the report and click OK.

Click thumbnail to view larger image.

Published date: 12/03/2021