Posting Payments and Adjustments

After you review your Edit Report, make any corrections, and print checks and the check register, you are ready to post the payment and adjustment transactions. Posting updates the vendor files, General Ledger accounts, and Bank Reconciliation files, if Accounts Payable is integrated to those modules.

NOTE: We recommend you have all users exit modules affected by posting before you post. This can help prevent data corruption. |

To post payments, adjustments, and corrections:

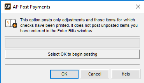

1 In Accounts Payable, select Payment Tasks > Post Payments from the left navigation pane.

Click thumbnail to view larger image.

2 Select OK to post.

The posting process first validates all of the information to ensure it meets the posting criteria. The information is written to the file, and then the posting/audit reports print to show the entries to each file and account. The open transactions are cleared and the system automatically deletes (multi-batch mode) or empties (single-batch mode) the batch.

As Accounts Payable validates transactions, it sometimes finds problems you must resolve before you can post the transactions. When this occurs, a Posting Error Report is generated that tells you exactly what is wrong. The report references the transaction number and the problem (see Printing the Posting Reports).

If any checks have not yet been printed, the system displays a detailed list of the unprinted checks. You can use the list as a reference to decide whether you want to print the checks before you post.

If a posting error occurs, see Correcting or Deleting Unposted Payments for more information to help you resolve them.

Published date: 12/03/2021