Calculating Finance Charges

If you charge your customers finance charges for late payments, you must set up at least one Terms Code. Each month, before you send out customer statements, generate the finance charge transactions automatically.

To calculate finance charges:

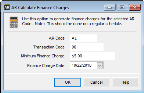

1 In Accounts Receivable, select Transaction Tasks> Calculate Finance Charges from the left navigation pane. The Calculate Finance Charges window will open.

Click thumbnail for larger view of image.

NOTE: Remember, AR Codes represent a group of similar customers. For example, wholesale customers. The finance charge you calculate is not applied to groups of customers with different AR Codes unless you leave the AR Code field blank to calculate for all AR Codes. |

3 In the Transaction Code field, select the transaction code that applies to these finance charge transactions.

Transaction Codes for finance charges begin with a 9. If you want your finance charges to be added to the customer balance so that the charge will be included in future finance charge calculations, enter a Transaction Code that starts with 1 or 2.

4 In the Minimum Finance Charge field, enter a minimum finance charge amount to assess (between 00.00 and 100.00).

A finance charge is set up as a percentage of the amount due on the customer record. If, when you calculate transactions, the percentage amount is less than the dollar amount you enter in this field, the system will charge the amount you enter in this field. If the percentage amount is larger than the amount in this field, the system charges the percentage amount.

5 In the Finance Charge Date field, enter the date for which the finance charges will be calculated.

6 Select OK to calculate finance charges.

NOTE: After finance charges are calculated, you must post them to update the customer accounts. |

Published date: 12/31/2020