Defining Credit Card Codes

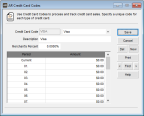

You can set up Credit Card Codes in Accounts Receivable and Sales to track your credit card transactions according to each type of card you accept, to quickly see the merchant’s percent for accepting each card type, and to track credit card transactions for each period in your Fiscal Calendar.

You must set up at least one Credit Card Code and one Clerk Code before you can accept credit cards as payment.

When credit card transactions are posted in Accounts Receivable, the totals are automatically adjusted in the AR Credit Card Codes window based on the credit card number.

To set up Credit Card Codes:

1 In Accounts Receivable, select Options > Set Up Credit Card Tracking from the left navigation pane.

Click thumbnail for larger view of image.

2 In the Credit Card Code field, enter a code up to six characters and select the type of credit card this code represents.

If you define multiple codes for the same card (e.g., Visa, Visa 2) and you use authorization software, credit card data automatically posts to the first corresponding card type (e.g., Visa).

3 In the Description field, enter a meaningful description you can use to identify this code later.

4 In the Merchant’s Percent field, enter the amount you owe to the merchant for accepting this credit card type.

The information in the grid is informational only and automatically updates when you post credit card transactions.

The information in the grid is informational only and automatically updates when you post credit card transactions.

5 Save the Code.

Published date: 12/31/2020