Closing the Year in General Ledger

Year-end processing posts the closing entries, rolls the fiscal calendar to the new year, and compacts the audit trail detail into balance forward amounts for each account. You need to complete year-end processing in all other modules before you begin the year-end closing process in General Ledger.

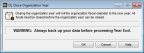

Be sure to back up your data before you close the year. If you encounter any problems during the closing process, you can always restore your data and begin again. You can also archive your organization if you want to access it in the future, but not restore old data into your current company.

Before you close your year, make sure you have a Retained Earnings/Fund Balance account defined in your chart of accounts (see Creating Accounts for instructions on how to set up an account). This type of account is used to hold the portion of equity that is a result of profit/revenue.

In General Ledger, select Period End Tasks > Close the Organization’s Fiscal Year from the navigation pane. This option will only be available if rights are set up to allow it. Use the Lookup or type in your Retained Earnings account number. Select OK to close the year.

The Controller module must be closed before you close the year.

NOTE: (Fund product only) You cannot close the organization year until all funds have been processed. You must close each fund separately at year-end, even if all funds use the organization calendar. |

Click thumbnail to view Business image.

Click thumbnail to view Fund image.

Published date: 09/30/2021